Many individuals consider mortgage refinancing as a viable option to improve their financial situation, but navigating this process can be overwhelming. Understanding the dos and don’ts of mortgage refinancing is crucial to making informed decisions that can positively impact your future. Let’s explore the key factors to keep in mind when considering mortgage refinancing to ensure a smooth and beneficial experience.

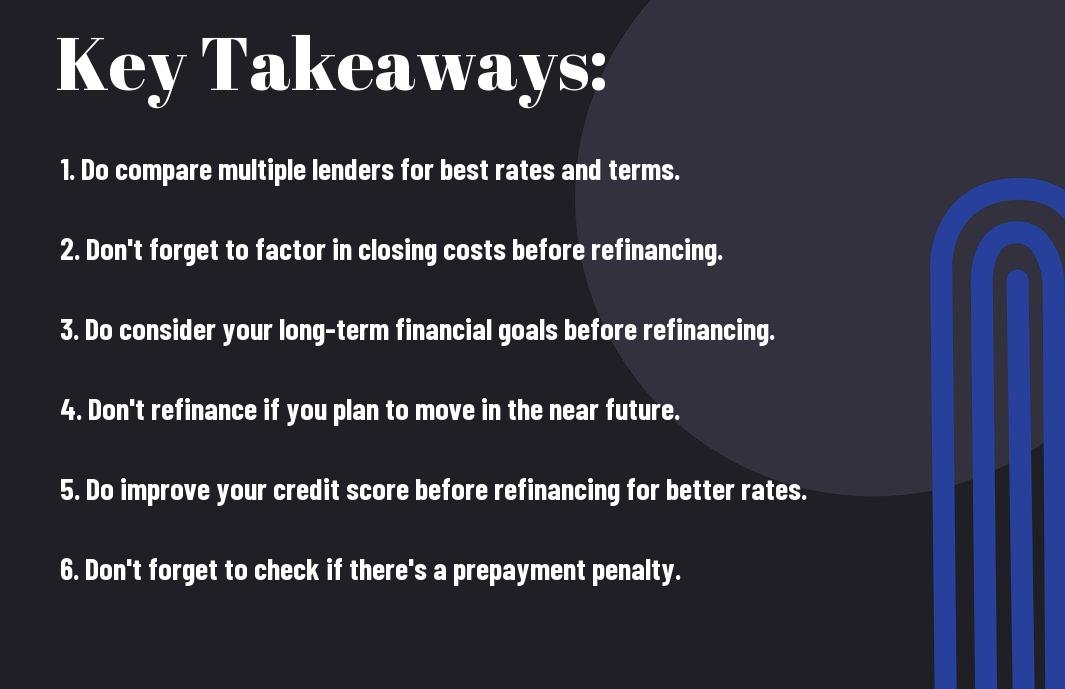

Key Takeaways:

- Do: Shop around for the best refinancing rates and terms to ensure you’re getting the most favorable deal.

- Do: Consider your financial goals and how a refinance can help you achieve them, whether it’s lowering monthly payments, shortening the loan term, or accessing equity.

- Don’t: Forget to factor in all the costs associated with refinancing, including closing costs, fees, and any prepayment penalties that could negate the benefits of refinancing.

Do: Research Interest Rates

Compare lender rates

You should do your homework before deciding on a lender for your mortgage refinancing. Start by comparing interest rates from different lenders. Here is a comparison of interest rates from various lenders:

| Lender | Interest Rate |

|---|---|

| ABC Bank | 3.5% |

| XYZ Credit Union | 3.3% |

| 123 Mortgage Company | 3.7% |

Watch market trends

Market trends can significantly impact interest rates. Keeping an eye on market trends can help you decide the best time to refinance your mortgage. A slight change in the market can result in savings or increased costs on your loan. Stay informed about the market to make informed decisions about your mortgage refinancing.

Do: Check Credit Score

You should always check your credit score before applying for mortgage refinancing. Your credit score plays a crucial role in determining the interest rate you will receive. A higher credit score can help you qualify for lower interest rates, which can save you money in the long run.

Review credit report

One important step in checking your credit score is to review your credit report for any errors. Make sure all the information is accurate, and if you find any discrepancies, be sure to address them before applying for refinancing. You can request a free copy of your credit report from the major credit bureaus once a year.

Improve score pre-application

Preapplication, consider taking steps to improve your credit score. This can include paying down existing debts, making all your payments on time, and avoiding opening new lines of credit. By improving your credit score before applying for mortgage refinancing, you can increase your chances of qualifying for better terms and rates.

Do: Consider Closing Costs

After you’ve decided to refinance your mortgage, it’s important to consider the closing costs involved. These costs can add up quickly and impact the overall savings you may experience from refinancing.

Estimate fees, expenses

Estimate the various fees and expenses associated with refinancing your mortgage. These may include application fees, origination fees, appraisal fees, title insurance, and more. Getting an accurate estimate of these costs will help you make an informed decision.

Assess break-even point

You’ll want to assess the break-even point of your refinance. This is the point at which the cost of the refinance is recouped through the monthly savings on your mortgage payment. By knowing your break-even point, you can determine if refinancing is a financially sound decision for you.

A break-even analysis can help you understand how long it will take to start saving money after refinancing. It’s important to factor in how long you plan to stay in your home and whether the savings will outweigh the upfront costs of refinancing. This will ensure that you’re making a smart financial choice for your future.

Do: Determine Goals

Shorten loan term

On your mortgage refinancing journey, one of your goals may be to shorten the loan term. This can help you pay off your mortgage faster and potentially save money on interest in the long run. By refinancing to a shorter term, you may also build equity in your home more quickly.

Lower monthly payments

Clearly, another goal you might have when refinancing your mortgage is to lower your monthly payments. This could provide you with more breathing room in your budget, allowing you to allocate funds towards other financial goals or expenses. By securing a lower interest rate or extending the loan term, you may achieve a more manageable monthly payment.

Do: Gather Documentation

Prepare financial records

All homeowners looking to refinance their mortgage should start by preparing their financial records. This includes gathering recent pay stubs, tax returns, and bank statements. By having these documents on hand, you can streamline the refinancing process and provide your lender with the necessary information to assess your financial situation.

Organize necessary paperwork

While gathering your financial records is important, organizing necessary paperwork is just as important. Make sure to have all relevant documents in one place, such as your current mortgage statement, homeowner’s insurance information, and any other assets or debts. This will help you stay organized and make the refinancing process much smoother.

Organize your paperwork in a folder or binder so that you can easily access the documents when needed. Label each section clearly to ensure nothing gets misplaced. Being organized will not only save you time but also show your lender that you are prepared and responsible, increasing your chances of a successful mortgage refinance.

Don’t: Overlook Hidden Fees

Read fine print

For a successful mortgage refinancing experience, it’s crucial not to overlook any hidden fees that may come with the new loan. Make sure to read the fine print of your agreement thoroughly to understand all the costs involved. Sometimes, seemingly small fees can add up over time and significantly impact the overall cost of your loan.

Question unclear charges

Dont hesitate to question any unclear charges or fees listed in your refinancing documents. If something seems confusing or unfamiliar, ask your lender to explain it in detail. It’s necessary to have a clear understanding of all the charges you are expected to pay so that you can make an informed decision about your refinance. Your lender should be able to break down the costs and help you understand where each fee is going.

While questioning unclear charges can seem intimidating, it’s crucial to advocate for yourself and ensure transparency in your refinancing process. By asking for clarification on any fees that are unclear to you, you can avoid surprises down the line and make sure you are getting the best deal possible.

Don’t: Skip Rate Lock

Secure interest rate

Now, the importance of rate lock cannot be emphasized enough when it comes to mortgage refinancing. By securing your interest rate, you protect yourself from any potential rise in rates before your loan closes. This will ensure you get the rate you agreed upon with your lender, even if the market rates go up.

Avoid market fluctuations

With rate lock, you can avoid market fluctuations that could increase your monthly payments unexpectedly. It gives you peace of mind knowing exactly what your rate will be, allowing you to budget accordingly without worrying about market changes impacting your mortgage payments.

A rate lock typically lasts for a set period, usually 30 to 60 days, but some lenders may offer longer lock periods. During this time, your interest rate is secured, and even if rates in the market increase, your rate stays the same. However, if rates decrease, you may not be able to take advantage of the lower rates unless you have specific terms in place with your lender.

Don’t: Refinance Frequently

Analyze cost-benefit

Keep in mind that refinancing your mortgage frequently can result in significant costs. Before making a decision, it’s important to analyze the cost-benefit of refinancing. Consider factors such as closing costs, interest rates, and how long you plan to stay in your current home.

Notice prepayment penalties

The key thing to remember is to check for any prepayment penalties in your current mortgage agreement before refinancing. These penalties can negate any potential savings from refinancing and end up costing you more in the long run.

It’s imperative to carefully review your current mortgage terms and conditions to ensure you understand any prepayment penalties that may apply. Some lenders impose penalties if you pay off your loan early, which could eat into any savings you were hoping to achieve through refinancing.

Don’t: Drain Equity

Concerning mortgage refinancing, it’s important to be mindful of your home equity. While it can be tempting to take out a large sum of money when refinancing, draining your equity entirely is not advisable. It’s imperative to strike a balance between accessing funds and maintaining a healthy level of equity in your home.

Keep sufficient equity

For optimal financial security, it’s recommended to keep a sufficient amount of equity in your home when refinancing. Lenders typically prefer borrowers to have at least 20% equity in their property. This not only improves your chances of approval but also helps you secure better loan terms and interest rates.

Avoid excessive borrowing

You’ll want to avoid excessive borrowing when refinancing your mortgage. While it may be tempting to cash out on your home’s equity, taking out more than you need can lead to higher monthly payments and a longer repayment period. Be mindful of your financial goals and borrow only what is necessary to avoid putting yourself in a challenging financial position.

Don’t: Choose Wrong Loan

Avoid unsuitable terms

If you rush into refinancing without carefully considering the terms of the loan, you could end up with a loan that doesn’t suit your financial situation. Avoid jumping into a loan with high interest rates, hidden fees, or a long repayment term that will cost you more in the long run.

Match loan to situation

If you’re considering refinancing, take the time to match the loan to your current financial situation. An adjustable-rate mortgage may be a good option if you plan to sell your home within a few years, but a fixed-rate mortgage could provide more stability if you plan to stay in your home for a longer period.

It’s important to understand your financial goals and choose a loan that aligns with them. A mortgage lender can help you explore different options and find the best loan for your specific needs.

Summing up

Conclusively, understanding the dos and don’ts of mortgage refinancing is necessary for making informed decisions about your financial future. By following the dos like researching thoroughly, comparing offers, and considering the long-term benefits, you can ensure a successful refinancing process. Remember to avoid the don’ts like neglecting your credit score, not shopping around for rates, and ignoring closing costs to prevent potential pitfalls. Taking these factors into account will help you navigate the refinancing process smoothly and secure a better financial future for yourself and your family.